Buy Gold Bars from Africa | Complete Guide For Investors in 2025

Africa has long been a key player in the global gold market, and as we enter 2025, it remains one of the richest sources for high-quality gold bars. From Uganda to South Africa, and Ghana, African nations continue to produce gold with exceptional purity levels, such as 22K and 24K. As demand for gold in Asia continues to rise, now is an excellent time to consider buying gold bars directly from Africa.

At Gold Buyers Africa, we specialize in connecting gold investors with trustworthy suppliers across the continent. Whether you’re a seasoned investor or a first-time buyer, our platform provides expert advice, transparent processes, and the best prices to ensure that your investment is secure.

In this guide, we’ll walk you through everything you need to know about buying gold bars from Africa to Asia in 2025—from understanding market trends and gold purity, to navigating the legal complexities of international transactions

Why Invest in African Gold Bars in 2025?

1 Abundant Resources. Africa is known as one of the richest gold mines worldwide and produces high-quality gold bars giving at purity levels of 22K and 24K. Countries like South Africa, Uganda, Ghana, and Tanzania are the main producers of gold making it a location for gold investment. Buy Gold Bars From Africa

2 Competitive Prices. Gold bars in Africa can often be brought at lower prices compared to world markets especially if bought directly from miners or local dealers because the blockers are eliminated which gives investors to maximize returns.

3 Direct Sourcing Opportunities. Africa provides a chance for to Investors get gold bars directly from African miners and handmade sources this helps to ensure a transparent supply chain and build relationships that can lead to further opportunities.

4 Strategic Investment Location. Many African countries like Uganda, Ghana, and South Africa are known for their stable and growing mining sector that has favorable investment policies. Their geographical location gives easy access to investors and easy exporting of gold from Africa.

5 Growing Demand and Market. With the increased demand for African gold bars around the world buying gold from Africa can be a profitable decision for those looking to increase their profits through gold and an increasingly accessible market. Buy Gold Bars From Africa

Step-by-Step Process of Buying Gold Bars from Africa

1 Research Reliable Gold Suppliers in Africa

Always work with trusted companies like Gold Buyers Africa which has a reputation for ethical sourcing and legitimate transactions and the company’s credentials and past customer reviews to ensure authenticity.

2 Verify the Quality and Purity of the Gold

Always ensure the gold bars meet purity standards like 24K and 22K, used for investment-grade gold to confirm authenticity through third-party assays or certifications.

3 Understand the Legal Regulations in Both Regions

Always comply with export regulations in the African country like obtaining documentation for legal gold trade, and research import regulations and taxes in your Asian country to avoid potential legal issues.

4 Arrange for Secure Transportation

Always choose secure logistics solutions with insurance to ensure the safe transport of gold bars from Africa to Asia Work with trusted shipping companies that specialize in handling high-value items.

5 Complete the Transaction through Secure Payment Methods

Always use secure payment methods that have more transparency like bank wire transfers and escrow services these ensure a fair and transparent transaction

Key Benefits of Buying Gold Bars from Africa

1 High Purity Levels. African gold bars have high purity levels mostly from countries like Ghana, South Africa, and Tanzania which are known for their high-quality gold mining operations.

2 Cost-Efficiency. Buying gold bars directly from African miners can give competitive pricing allowing for potential savings and higher profit value.

3 Diverse Gold Sources. Africa has a variety of gold-producing countries which enables buyers to choose between different suppliers to meet their investment needs.

4 Strong Investment Demand. Gold is a valuable and reliable investment in Asia and Europe making African gold bars a smart choice for investors looking for stable and long-term returns.

Best places to Buy Gold Bars in Africa.

1 Ghana: The Gold Coast of Africa

Reputable Markets and Companies:

1 Accra Gold Market: Located in the capital city, this market is a hub for gold traders and miners. Investors can find gold bars of various purities and sizes.

2 Obuasi Mines: Operated by AngloGold Ashanti, Obuasi is one of the largest gold mines in Africa, offering certified gold bars for investors.

3 Gold Buyers Africa: A trusted company that connects international buyers with authentic gold sellers in Ghana.

Why Ghana?

1 Strong government regulations ensure transparent transactions.

2 High-quality gold bars with purities of up to 24K are readily available.

2 Uganda: A Gateway for Gold Buyers

Reputable Markets and Companies:

1 Kampala Gold Market: Uganda’s capital is home to several licensed gold dealers and markets that cater to international buyers.

2 Gold Refinery Uganda: A reliable source for refined gold bars, ensuring international standards of purity.

3 Gold Buyers Africa: A leading company offering secure transactions and direct access to miners in Uganda.

Why Uganda?

1 Competitive pricing due to lower mining costs.

2 Flexible export policies make it easier to transport gold bars internationally.

3 Tanzania: The Land of Kilimanjaro and Gold

Reputable Markets and Companies:

1 Dar es Salaam Gold Market: Known for its vibrant trade, this market connects buyers with miners and local sellers.

2 Geita Gold Mine: One of Tanzania’s largest mines, offering certified gold bars directly from the source.

3 Gold Buyers Africa: A trusted intermediary that ensures safe and authentic purchases in Tanzania.

Why Tanzania?

1 Rich gold reserves, particularly in regions like Mwanza and Geita.

2 Transparent licensing processes for buyers and exporters.

4 South Africa: Africa’s Economic Powerhouse

Reputable Markets and Companies:

1 Johannesburg Gold Market: A central hub for buying and selling gold bars, featuring reputable dealers and refiners.

2 Rand Refinery: One of the world’s largest gold refineries, known for producing high-quality gold bars.

3 Gold Buyers Africa: Assists buyers in navigating South Africa’s gold markets and ensures secure transactions.

Why South Africa?

1 Home to the world-famous Witwatersrand Basin, which has produced over 40% of all gold mined globally.

2 High standards of refinement and certification for gold bars.

5 Congo (DRC): The Treasure Trove of Central Africa

Reputable Markets and Companies

1 Bukavu Gold Market: Located near the eastern mining regions, this market is a key point for purchasing gold bars directly from miners.

2 Kibali Gold Mine: Operated by Barrick Gold, Kibali offers certified gold bars for export.

3 Gold Buyers Africa: Facilitates secure transactions and connects buyers to reliable sellers in Congo.

Why Congo?

1 Vast, untapped gold reserves make it a cost-effective option for investors.

2 Opportunities to buy gold directly from artisanal miners, often at competitive prices.

Key Tips for Buyers

1 Always verify the authenticity of gold bars using certified methods or third-party testing.

2 Work with trusted companies like Gold Buyers Africa to ensure secure and legitimate transactions.

3 Familiarize yourself with the legal requirements for buying and exporting gold in each country.

How to Verify the Quality and Purity of African Gold Bars

1 Request Assay and Certification. Make sure to only buy gold with certifications from reputable assay laboratories and confirm the purity and quality.

2 Perform Third-Party Inspections. Always before shipping can use a third-party inspection service before shipment to verify authenticity.

3 Partner with Reliable Dealers. Always work with reputable companies like Gold Buyers Africa that secure sourcing and certification for gold buyers to ensure authenticity and quality.

4 Verify Consistency in Gold Purity. Make sure that each bar is consistent in purity mostly if buying in bulk this will help to know if the bars you are buying meet the international standards. Buy Gold Bars From Africa

Legal Regulations for Buying and Transporting Gold Bars from Africa to Asia

1 Ghana

Legal Requirements:

1 License to Purchase Gold: Buyers must obtain a license from the Minerals Commission of Ghana.

2 Export Permit: Required for exporting gold, issued by the Precious Minerals Marketing Company (PMMC).

3 Taxes and Fees: Exporters are subject to a 3% withholding tax on gold exports.

4 Customs Clearance: Gold must be declared at the port with proper documentation, including invoices and permits.

Tips:

1 Only deal with sellers licensed by the PMMC.

2 Verify the authenticity of all documents through Ghana’s Minerals Commission.

2 Uganda

Legal Requirements:

1 Trading License: International buyers must work with entities licensed by the Ministry of Energy and Mineral Development.

2 Export Certificate: Issued by the Uganda Revenue Authority (URA) after assessing purity and value.

3 Taxes: Export duty on refined gold ranges from 1% to 5%.

4 Customs Clearance: Gold must be declared at customs with export certificates and proof of payment of taxes.

Tips:

1 Work with trusted intermediaries like Gold Buyers Africa to ensure compliance.

2 Conduct due diligence on sellers to confirm their licensing status.

3 Tanzania

Legal Requirements:

1 Dealership License: Buyers must transact with licensed dealers, as issued by the Mining Commission.

2 Export Permit: Mandatory for all gold exports, processed through the Ministry of Minerals.

3 Taxes: A 6% royalty fee is applied to gold exports.

4 Customs Clearance: Exporters must declare gold with a Certificate of Origin and proof of tax payments.

Tips:

Avoid purchasing gold from unlicensed artisanal miners.

Use verified transport companies to minimize risks during exportation.

4 South Africa

Legal Requirements:

1 Mining Permit: Only licensed companies and entities can sell gold.

2 Export Authorization: Issued by the South African Diamond and Precious Metals Regulator (SADPMR).

3 Taxes: A VAT of 15% applies, but exemptions are available for export purposes.

4 Customs Clearance: Requires detailed documentation, including invoices, export permits, and SADPMR certification.

Tips:

1 Partner with established gold refineries like Rand Refinery.

2 Avoid cash transactions to ensure traceability and compliance.

5 Congo (DRC)

Legal Requirements:

1 License for Gold Trade: Buyers must obtain a permit from the Ministry of Mines.

2 Export Certificate: Required for all gold leaving the country, issued after proper valuation.

3 Taxes: Export duties range between 3% and 5%.

4 Customs Clearance: Gold must be declared with an accompanying Certificate of Origin.

Tips:

1 Ensure the seller has a valid artisanal or small-scale mining license.

2 Avoid dealing with sellers operating in conflict zones, as the gold may be linked to illicit activities.

General Tips for Avoiding Legal Issues

1 Work with Licensed Dealers. Verify that the seller holds a valid license issued by the country’s mining authority.

2 Ensure Proper Documentation. Always request and verify key documents like export permits, tax payment receipts, and Certificates of Origin.

3 Conduct Due Diligence. Research sellers thoroughly and confirm their authenticity through trusted intermediaries like Gold Buyers Africa.

4 Understand Local Laws. Familiarize yourself with the specific gold trading and export regulations in the country of purchase.

5 Engage Professional Assistance. Use experienced logistics companies for customs clearance and gold transportation to avoid procedural errors.

6 Avoid Cash Transactions. Opt for traceable payment methods to comply with anti-money laundering laws.

Gold prices in different African countries

| COUNTRIES | GOLD WEIGHTS | PRICES |

| 1 gram | $62–$64 | |

| Ghana | 1 ounce | $1,950–$2,010 |

| 1 kilogram | $62,500–$64,500 | |

| Uganda | 1 gram | $63–$66 |

| 1 ounce | $1,900–$2,000 | |

| 1 kilogram | $63,000–$66,000 | |

| South Africa | 1 gram | $62–$65 |

| 1 ounce | $1,930–$2,020 | |

| 1 kilogram | $62,000–$65,000 | |

| Kenya | 1 gram | $61–$64 |

| 1 ounce | $1,890–$1,970 | |

| 1 kilogram | $61,000–$64,000 | |

| Congo | 1 gram | $60–$63 |

| 1 ounce | $1,850–$1,930 | |

| 1 kilogram | $60,000–$63,000 | |

| Tanzania | 1 gram | $62–$65 |

| I ounce | $1,940–$2,010 | |

| 1 kilogram | $62,000–$65,000 |

NB ‘Not that gold prices change depending on the current world market’

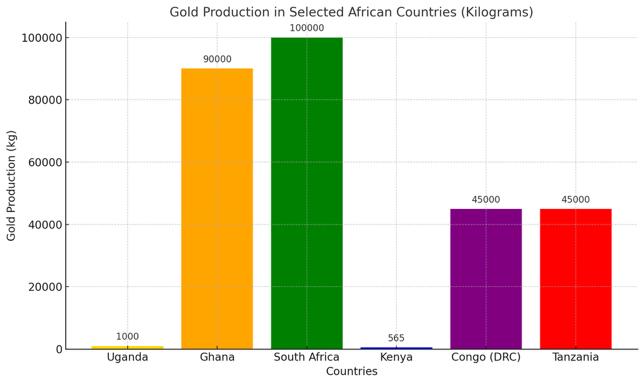

The Current gold production in Africa

This gold production will to guide investors make a good choice in Africa

Tips for Transporting Gold from Africa to Asia Safely

1 Choose a Reputable Shipping Partner. Always Work with logistics providers who are reputable and experienced in transporting gold from Africa to the world contact Gold Buyers Africa to support you in this process.

2 Use Tracking Services and Insurance. When shipping your gold from Africa make sure you are provided with tracking for real-time updates on your shipment.

3 Insist on Tamper-Proof Packaging. Make sure that your gold is securely packed to prevent tampering or loss during the transportation process.

4 Arrange Customs Clearance in Advance. Always make proper arrangements and consult with customs agents to streamline the customs process to avoid delays. Buy Gold Bars From Africa

Mistakes to Avoid When Buying Gold Bars from Africa

Africa’s gold market offers great opportunities for investors, but it also comes with risks if proper precautions aren’t taken. Avoiding common mistakes can ensure a smooth and successful transaction.

1 Dealing with Fraudulent Sellers

Mistake:

1 Purchasing gold from unlicensed or fraudulent sellers who may provide counterfeit or impure gold bars.

2 Falling for scams such as offers of gold at unrealistically low prices.

Prevention Tips:

1 Verify Seller Credentials: Ensure the seller is licensed and registered with the appropriate government agency.

2 Conduct Background Checks: Research the seller’s reputation online or through trusted intermediaries.

3 Use a Trusted Company: Work with established entities like Gold Buyers Africa, which connects buyers to reliable sellers.

2 Ignoring Export Regulations

Mistake:

1 Attempting to export gold without the required permits or documentation.

2 Overlooking export taxes and fees, leading to delays or legal penalties.

Prevention Tips:

1 Understand Local Laws: Familiarize yourself with export requirements, including taxes, permits, and customs processes.

2 Engage Experts: Hire professionals to handle documentation and customs clearance.

3 Obtain Export Permits: Always ensure you have the necessary export certificates and licenses before transporting gold.

3 Failing to Verify the Purity of Gold Bars

Mistake:

1 Buying gold without confirming its purity or relying solely on the seller’s claims.

2 Investing in gold bars with lower purity than advertised reduces resale value.

Prevention Tips:

1 Test the Gold: Use third-party testing methods, such as XRF machines or acid tests, to verify purity.

2 Request Documentation: Ask for a Certificate of Purity from a certified refinery or testing authority.

3 Inspect Packaging: Ensure the gold bars come in sealed, tamper-proof packaging with authenticity marks.

4 Underestimating the Importance of Due Diligence

Mistake:

1 Rushing into a transaction without proper research on the seller, the local gold market, or export processes.

2 Neglecting to verify the source of the gold, which could lead to purchasing illegally mined or conflict gold.

Prevention Tips:

1 Research the Market: always understand the current gold prices and trends in the country you are buying from.

2 Check the Source: always confirm the gold originates from legitimate and ethical mining operations by asking for the letter of origin.

3 Work with Intermediaries: make sure to use reputable companies to help you vet sellers and ensure compliance.

5 Ignoring Transportation and Security Measures

Mistake:

1 Transporting gold without proper security, leading to theft or loss.

2 Relying on unverified shipping companies or informal channels.

Prevention Tips:

1 Insure the Shipment: Always secure comprehensive insurance for the gold during transit.

2 Use Trusted Logistics Firms: Partner with companies experienced in transporting precious metals.

3 Plan Secure Routes: Work with professionals to map out safe and compliant transportation paths.

6 Falling for Unrealistic Offers

Mistake:

1 Believing offers that promise gold at prices significantly below market rates.

2 Overlooking red flags such as sellers demanding upfront payments without documentation.

Prevention Tips:

Know Market Prices: Stay updated on current gold prices to spot unrealistic deals.

Be Cautious of Upfront Payments: Only make payments through secure, traceable methods after verifying the seller and the product.

Tips for Ensuring a Smooth Transaction

1 Work with Reliable Partners. Make sure you choose trusted companies like Gold Buyers Africa for secure transactions and compliance assistance.

2 Follow Local Regulations. Make sure you understand the legal requirements in the country you are buying from to ensure all documentation is in order.

3 Hire Legal and Logistical Experts. Always have support from professionals to handle contracts, permits, and transportation for added security.

4 Inspect the Gold Before Purchase. Make sure you fix the time and conduct gold inspections and purity tests to confirm the quality of the gold bars.

5 Keep Detailed Records. Always have proper maintenance of receipts, contracts, and export documents to avoid disputes or legal complications.

6 Communicate Transparently. Make sure before you buy gold understand all clear terms of buying, payment, and delivery with the seller to avoid misunderstandings.

Export Tax and Fees for Gold Bars in Africa

1 Ghana

1 Export Duty: Gold exports are subject to a 3% withholding tax on the gross value of the gold.

2 Additional Fees: Fees for export permits and certifications from the Precious Minerals Marketing Company (PMMC) apply.

3 Documentation Costs: Includes costs for Certificates of Origin, invoices, and valuation reports.

2 Uganda

1 Export Duty: Refined gold incurs a 1% to 5% tax, depending on the purity and value.

2 Certification Fees: Buyers must pay for an export certificate issued by the Uganda Revenue Authority (URA).

3 Other Costs: Valuation and assay charges may apply for purity testing.

3 Tanzania

1 Royalty Fees: A 6% royalty is charged on the value of gold exports.

2 Clearing Fees: Exporters must pay customs clearance fees, which vary by shipment size and destination.

3 License Costs: Fees for export licenses issued by the Mining Commission.

How to Calculate Gold Total Costs, Including Taxes and Fees

1 Determine Gold Value. Calculate the total value of the gold based on the current market price and weight (e.g., price per gram multiplied by total grams).

2 Apply Export Duties and Taxes. Multiply the gold’s value by the applicable export tax or royalty percentage (e.g., 3% for Ghana or 6% for Tanzania).

3 Include Certification and Documentation Fees. Add costs for permits, certificates, and testing (typically $100–$500 depending on the country).

4 Account for Transportation and Insurance. Include shipping fees and insurance to safeguard the gold during transit.

5 Sum Up Total Costs. Combine all expenses, including taxes, permits, and logistical costs, to arrive at the total export cost.

Example

- Gold Value: $50,000

- Export Tax (3% in Ghana): $1,500

- Certification Fees: $300

- Shipping & Insurance: $1,200

- Total Cost: $53,000

Top Benefits of Buying 24K Gold Bars from Africa

Africa is a leading source of high-purity 24K gold bars, offering unique advantages to buyers and investors:

1 Competitive Prices

Africa’s gold markets, particularly in countries like Ghana, Uganda, and Tanzania, offer lower premiums on 24K gold bars compared to international markets and the gold mines eliminate additional middleman costs.

2 Access to Ethical Gold

Countries like Uganda and Ghana have increasingly adopted responsible mining practices, offering buyers access to conflict-free gold.

3 High Purity Standards

24K gold bars from Africa typically meet the highest purity standards (99.9% or higher), making them ideal for investment and many African countries offer certification to verify purity through internationally recognized assays.

4 Diverse Sourcing Opportunities

Buyers can purchase gold directly from local miners, reputable refineries, or government-authorized dealers, ensuring transparency and reliability.

5 Investment Potential

Gold prices in Africa are often more stable and aligned with global market trends, providing an opportunity for long-term appreciation.

24K gold bars are considered a secure hedge against inflation and economic uncertainty.

Essential Documents for Exporting Gold from Africa to Asia

METHODS TO IDENTIFY THE PURITY OF GOLD BARS IN AFRICA

High quality Gold bars in Africa can be identified by buyers in various methods such as conducting a specific gravity test, performing an acid test, magnetic testing, hallmarking, X-ray fluorescence, and using an electronic gold tester. These tests can help buyers determine high-quality and purity Gold bars while purchasing. Buy Gold Bars From Africa

Frequently Asked Questions (FAQs) on Importing Gold from Africa to Asia

How do I ensure I’m buying authentic gold from Africa?

Always work with reputable gold suppliers request official certificates of purity and use a trusted service like Gold Buyers Africa for verified sourcing. Buy Gold Bars From Africa

Are there import taxes on gold in Asia?

Import taxes vary by country it is better to consult with a customs expert in your country to understand the applicable tariffs and fees.

What documents are required for exporting gold from Africa?

Mostly you’ll need to have an export license, proof of origin, and quality certifications and check specific requirements with your African gold supplier.

Buying gold bars from Africa is a smart investment choice for those looking to diversify their portfolio and secure their financial future. With the help of platforms like Goldbuyersafrica, buyers can easily connect with reputable sellers and purchase high-quality gold bars directly from the source. By following these tips and guidelines, buyers can ensure a smooth and successful gold-buying experience. Buy Gold Bars From Africa