How Gold Long Term Returns Outperform Normal Investment | in 2024

Gold Long-Term Returns, gold has long been known as a great investment opportunity. However, its true investment potential is often underestimated. Differing from normal investments, gold’s long-term returns can outperform many traditional investment ideas providing both stability and profitability for understanding investors. In this blog post, we are to take you through reasons why investing in gold makes sense, how its performance stacks up over time, and how Gold Buyers Africa can help you make the most of this opportunity.

How To Use Gold Long-Term Returns

Many investors see gold only as a hedge against inflation or economic uncertainty, but it gives much more. Gold’s shortage, basic value, and world demand make its prices flexible. Historical information shows that gold’s long-term performance beats normal investments like bonds or savings accounts, especially during unstable economic cycles.

Key Statistics

- Gold is not just a crisis asset but also a smart long-term investment with strong growth potential.

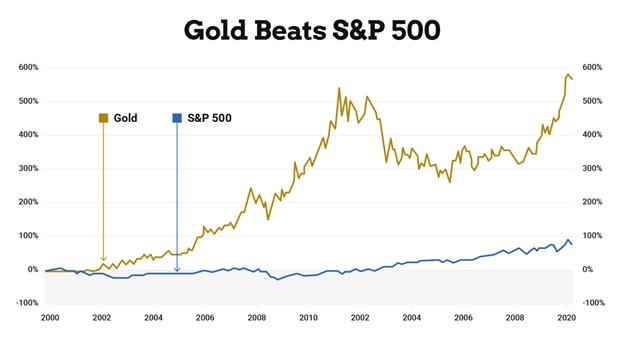

- Over the last 50 years, gold has had an average annual return of around 10%, compared to the stock market’s average of 7% during the same period.

- During economic downturns, gold prices have historically surged, providing a hedge against market crashes. Gold Long-Term Returns

Gold vs. Other Investments: A Performance Comparison

Gold has shown impressive returns over the years compared to stocks, real estate, and government bonds. The table below indicates gold’s annualized growth against these assets:

| Asset | 10-year Annualized Return (%) |

| Gold | 9-10% |

| Real Estate (USA) | 7-8% |

| S&P | 7-9% |

| Government Bond | 3-4% |

Why Gold Long-Term Returns Outperforms

- Increasing Demand. The highly increasing demand for gold remains valuable across all economic conditions as central banks continue to accumulate gold reserves, the demand for this precious metal is likely to increase which drives its long-term value.

- Inflation Hedge. One of the most compelling reasons to invest in gold is its ability to act as a hedge against inflation. Because when currencies lose value gold tends to maintain its buying power making it a reliable store of wealth.

- Safe Haven Asset. In times of geopolitical tension or financial crises, investors flock to gold, driving its prices higher. This unique characteristic makes gold a crucial component of a diversified investment portfolio.

- Low Correlation with Other Assets. Gold often moves independently of stocks and bonds, which means it can help reduce overall portfolio risk. By adding gold to your investment strategy, you can achieve a more balanced and resilient portfolio.

How Gold Provides an Investment Strategy

Adding gold to your investment portfolio can help reduce risks during market downturns. When stocks and real estate may underperform, gold tends to rise in value. This inverse relationship makes it an ideal hedge.

For example, financial experts recommend allocating 5-15% of your investment to gold for optimal balance.

The Role of Gold In Markets and Africa

With Africa being known for its major world gold market opportunities to buy gold directly from African miners have risen Uganda, Ghana, and the Democratic Republic of Congo (DRC) are leading producers, providing gold at competitive prices to buyers and investors.

At Gold Buyers Africa, we connect international investors with authentic gold sellers across Africa, ensuring a secure, profitable transaction. Our team ensures compliance with export regulations, making it easier for you to invest in African gold.

How to Invest in Gold for Maximum Returns

- Gold Bullion. Buying physical gold bars ensures you own a tangible asset with intrinsic value.

- Gold ETFs. Exchange-traded funds offer a more liquid way to invest in gold without handling physical storage.

- Physical Gold. Buying gold bars, coins, and jewelry can provide a tangible asset that you can hold. However, consider storage and insurance costs.

- Direct Gold Mining Investments. Partnering with miners in Africa gives you access to gold at source prices, maximizing profitability.

Why Choose Gold Buyers Africa for Your Gold Investment?

Gold Buyers Africa with their team of expertise and connections in the African gold market they can help investors access.

- Gold buyers Africa authentic gold bars directly from miners

- Gold buyers Africa have competitive prices and verified purity levels.

- Gold buyers Africa Safe transportation and export services.

Gold Buyers Africa provides a smooth and secure buying process if you’re buying gold bullion for personal investment or looking to increase your portfolio. Gold Long-Term Returns

Conclusion. Gold is more than just a hedge against inflation it’s a reliable long-term investment with the potential for significant returns. Its value continues to rise over time, proving that conventional wisdom often underestimates gold’s true potential. By working with trusted partners like Gold Buyers Africa, you can unlock the full potential of gold and secure your financial future.

Start Your Gold Investment Journey Today!

Are you ready to invest in gold? Contact Gold Buyers Africa today and get to know how we can help you buy, store, and profit from gold in Africa. If you’re a seasonal investor or new to gold trading, we give you personalized investments depending on your needs. +256785307551

Frequently Ask Questions on How Gold Long-Term Returns Outperforms

Is gold a good investment during economic downturns?

Yes, gold performs well during economic instability which makes it a reliable asset for investors during downturns.

How can I ensure the authenticity of the gold I buy from Africa?

Partner with reputable companies like Gold Buyers Africa to verify purity and ensure you receive authentic gold.

What percentage of my portfolio should I allocate to gold?

Financial experts suggest dedicating 5-15% of your portfolio to gold for optimal diversification.

Gold Long-Term Returns