Gold Prices in Different African Countries | 24K, 22K & 18K Live Rates (1g to 1kg)

African countries are among the largest producers of gold globally, contributing significantly to the world’s precious metal market. However, the price of gold can vary from country to country due to factors such as production costs, demand, and prevailing economic conditions.

Gold Buyers Africa your trusted source known for providing up to date information on gold prices, trend and Analysis to help you have great investment choice in Africa, Let’s explore the prices of 24K gold in different African countries, providing insights into how much it costs per kilogram, per gram, and ounce. gold prices in different African countries

Factors Affecting Gold Prices in Different African countries

- Supply and Demand: Countries with higher gold production often have lower prices due to the abundant supply, while countries with limited access to gold may see higher prices.

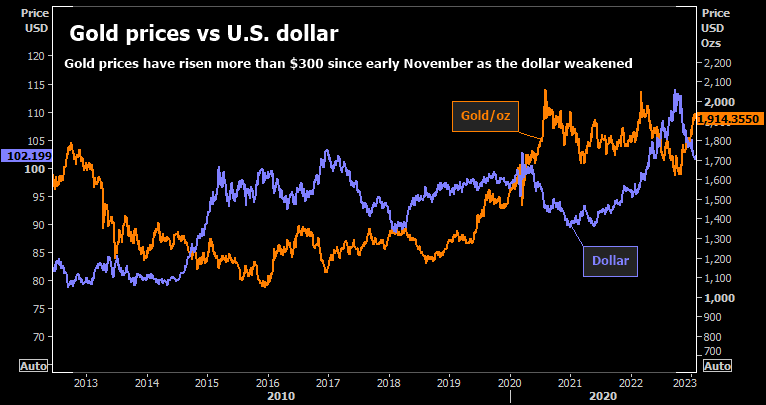

- Currency Exchange Rates: Since gold is traded in U.S. dollars, fluctuations in exchange rates can impact the local price of gold.

- Economic Stability: Countries experiencing economic instability may have higher gold prices as investors turn to gold as a safe-haven asset.

- Government Policies and Taxes: Import and export duties, as well as other regulations, can affect the price of gold in different countries.

Current 24k Gold Prices in Different African Countries

The table below presents the price of in various weights, including per kilogram, per gram, and per ounce, in different African countries. All prices are in U.S. dollars (USD) and are accurate as of the latest available data.

| Country | Price per Kilogram (USD) | Price per Gram (USD) | Price per Ounce (USD) |

| South Africa | $71,300 | $65.40 | $1,923.00 |

| Ghana | $68,200 | $61.40 | $1,902.80 |

| Tanzania | $71,450 | $61.35 | $1,907.40 |

| Uganda | $68,300 | $61.40 | $1,909.00 |

| Nigeria | $65,600 | $66.80 | $1,99.00 |

| DR Congo | $65,460 | $64.35 | $1,973.00 |

| Sudan | $66,200 | $64.30 | $1,965.50 |

| Zimbabwe | $63,550 | $63.55 | $1,811.00 |

Analysis of Gold Prices A cross-Africa

South Africa: As one of the world’s leading gold producers, South Africa has competitive gold prices. The cost per kilogram stands at $71,300, with a per-ounce price of $1,923.00. The large-scale production and established mining infrastructure contribute to the relatively stable and lower prices.

Ghana: Ghana, another major gold producer, offers slightly lower prices than South Africa. The price per kilogram is $68,200, translating to $1,902.80 per ounce. Ghana’s prices are influenced by its large gold reserves and production capabilities.

Tanzania and Uganda: These East African nations have prices slightly higher than Ghana, reflecting their growing but still developing mining sectors. The cost per kilogram in Tanzania is $71,450, while in Uganda, it is $68,300. +256785307551

Nigeria: Gold prices in Nigeria are higher compared to other African nations, with a price per kilogram of $65,600. This could be due to the country’s economic conditions and the challenges in gold production.

Democratic Republic of Congo (DR Congo): Despite its vast mineral wealth, DR Congo’s gold prices are slightly lower, likely due to political instability and the complexities of the mining industry.

Sudan and Zimbabwe: These countries also have competitive gold prices, with Sudan at $66,200 per kilogram and Zimbabwe at $63,550 per kilogram. Economic factors and mining policies in these nations play a crucial role in determining the prices.

To give you an overview of 22K gold prices in various African countries, I would present the prices per kilogram, per gram, and per ounce in U.S. dollars (USD). Keep in mind that 22K gold is slightly less pure than 24K gold, which is why its price is typically lower.

A Table Showing Current 22K Gold Prices in different African Countries

| Country | Price per Kilogram (USD) | Price per Gram (USD) | Price per Ounce (USD) |

| South Africa | $58,600 | $58.50 | $1,802.30 |

| Ghana | $57,400 | $55.30 | $1,647.00 |

| Tanzania | $56,800 | $57.50 | $1,682.00 |

| Uganda | $55,750 | $55.90 | $1,692.70 |

| Nigeria | $56,700 | $56.70 | $1,760.50 |

| DR Congo | $57,250 | $55.95 | $1,812.50 |

| Sudan | $57,413 | $57.00 | $1,841.00 |

| Zimbabwe | $56,660 | $57.15 | $1,861.44 |

Analysis of 22K Gold Prices

South Africa: The price of 22K gold in South Africa is $58,600 per kilogram, which is relatively competitive given the country’s large gold reserves and efficient mining industry.

Ghana: Ghana offers 22K gold at $57,400 per kilogram, slightly lower than in South Africa, due to its abundant gold production.

Tanzania and Uganda: These countries have similar prices for 22K gold, around $56,800 to $56,800 per kilogram, reflecting their developing gold markets. gold prices in different African countries

Nigeria: In Nigeria, the price is a bit higher at $56,700 per kilogram, likely due to the economic challenges and limited production capabilities.

DR Congo, Sudan, and Zimbabwe: These countries have prices ranging from $57,250 to $57,413 per kilogram, with slight variations due to local factors such as mining policies and economic conditions.

Which Country Has the Cheapest Gold in Africa Today?

Currently, Uganda has the cheapest gold in Africa due to lower production costs, minimal export restrictions, and a weak local currency against the USD.

Top 5 African Countries with the Cheapest Gold (2025)

| Rank | Country | Avg Price per Gram (24K) | Notes |

| 1 | Uganda | $54.30 | High output, low tax, weak currency |

| 2 | Mali | $55.10 | Large artisanal market, low overhead |

| 3 | Burkina Faso | $55.80 | Affordable mining costs |

| 4 | DR Congo | $56.00 | Abundant resources, less regulation |

| 5 | Tanzania | $56.40 | Steady supply, competitive market

|

Note. Prices may vary slightly based on purity, location, and dealer markup.

Why gold prices differ across African countries:

- Currency Exchange Rates

Gold is priced globally in USD, but each African country uses its local currency. If a country’s currency weakens against the U.S. dollar, gold becomes more expensive locally, even if the global price stays the same. For example, gold may cost more in Nigerian Naira than in Ghanaian Cedis due to currency fluctuations.

- Local Demand and Supply

Countries with strong domestic demand (e.g., for jewelry, investment, or export) often have higher gold prices due to local competition. In contrast, countries with an excess supply may sell gold at lower rates to attract buyers.

- Import & Export Policies

Taxes, government regulations, and customs duties can influence gold prices. For instance, a country that heavily taxes gold exports or restricts trade may have artificially inflated local prices, while others with liberal gold trade policies may offer more competitive rates.

- Refining and Purity Standards

Not all countries use the same gold purity standards or refining infrastructure. Some sell raw or unrefined gold, while others offer certified 24K or 22K bars, which are usually more expensive. Better-refined gold demands a premium price.

5. Dealer Markups and Market Competition

In countries where few dealers dominate the market, gold prices can be higher due to a lack of competition. In more competitive markets like Ghana or South Africa, multiple traders drive prices closer to international rates.

Why Invest in African Gold?

1 High Purity. African gold is known for its excellent quality, with many countries offering 99.9% pure 24K gold.

2 Competitive Prices. Compared to global markets, Africa provides lower premiums and better deals for investors.

3 Vast Opportunities. Whether you’re buying in bulk or small quantities, Africa’s diverse gold market provides great investment options.

Gold Price Predictions for 2025 & Beyond

Short-Term (2025 Outlook)

- Projected Price Range: $1,900 – $2,100 per ounce

- African gold prices may rise moderately due to continued global economic uncertainty and central banks increasing their gold reserves.

- Demand for gold from China and India will also play a key role in price fluctuations.

Mid-Term (2026-2027)

- Expected Price Range: $2,000 – $2,300 per ounce

- If inflation remains high and global economic instability persists, investors will likely turn to gold, pushing prices higher.

- African gold-producing countries may introduce more favorable policies to attract investment and streamline exports.

Long-Term (2028-2030)

- Potential Price Range: $2,200 – $2,500 per ounce

- Gold prices are expected to rise due to depleting gold reserves, increased mining costs, and growing demand from emerging markets.

- Africa’s gold industry could see significant expansion as countries like Nigeria, Uganda, and Ethiopia increase production.

Investment Opportunities in Africa’s Gold Market

1 Buying & Holding Physical Gold

- Investors can purchase gold bars, coins, or jewelry as a store of value.

- Countries like Ghana, South Africa, and Uganda have reliable gold markets.

2 Investing in Gold Mining Stocks

- African gold mining companies are a good investment option as production increases.

- Examples include AngloGold Ashanti (South Africa) and Harmony Gold.

3 Gold Export Business

- With the right permits, businesses can buy gold in Africa and export it to international markets, especially the USA and UAE.

4 Trading in Gold ETFs & Futures

- Investors can trade gold-backed exchange-traded funds (ETFs) to gain exposure to gold price movements without holding physical gold.

Interested in Buying Gold in Africa? Gold Buyers Africa is your go-to source for the latest gold prices, secure transactions, and trusted gold dealers.

Gold prices in Africa are influenced by a myriad of factors, including production levels, economic conditions, and government policies. Investors looking to buy gold from African countries should consider these variables to make informed decisions. The table provided offers a snapshot of current prices, helping buyers understand the cost differences across the continent. For those interested in purchasing gold, it’s essential to stay updated on the latest price trends and consider the various factors that may influence the market. Africa remains a key player in the global gold industry, offering diverse opportunities for investors.

gold prices in different African countries contact stay ahead of the curve and make informed decisions with gold buyers Africa +256785307551