Gold Rate in South Africa Today| Live 24K, 22K & 18K Prices & Where to Buy

The current gold rate in South Africa is approximately R1,290 per gram for 24K gold and R1,180 per gram for 22K gold, as of 2025. Prices fluctuate daily based on international gold markets, ZAR exchange rates, and local demand. Whether you’re buying gold jewelry, investing in bars, or trading in bullion, knowing the live gold price is essential. You can also track historical price trends, compare purity levels, and get updates on gold rates per gram, ounce, and kilogram right here.

A table of the 24K gold price in South Africa, both in South African Rand (ZAR) and US Dollars (USD) • 1 gram of 24K gold = R1,290

- 1 gram of 24K gold = $68 USD

(Exchange rates and gold spot prices may vary daily.) gold rate in South Africa

24K Gold Price in South Africa – ZAR & USD

| Weight | Price (ZAR) | Price (USD) |

| 1 gram | R1,290 | $68 |

| 2 grams | R2,580 | $136 |

| 5 grams | R6,450 | $340 |

| 10 grams | R12,900 | $680 |

| 20 grams | R12,900 | $1,360 |

| 50 grams | R64,500 | $3,400 |

| 100 grams | R129,000 | $6,800 |

| 250 grams | R322,500 | $17,000 |

| 500 grams | R645,000 | $34,000 |

| 1 kilogram | R1,290,000 | $68,000 |

Note: The gold price is based on an approximate market rate of: gold rate in South Africa

A detailed price table for 22K gold in South Africa, both in ZAR and USD, for sizes ranging from 1 gram to 1 kilogram.

Current Estimated Rate ( 2025):

- 1g of 22K gold = R1,180 ZAR

- 1g of 22K gold = $62 USD

(Based on daily gold spot prices and exchange rates; prices may slightly vary.)

22K Gold Price in South Africa – ZAR & USD (1g to 1kg)

| Weight | Price (ZAR) | Price (USD) |

| 1 gram | R1,180 | $62 |

| 2 grams | R2,360 | $124 |

| 5 grams | R5,900 | $310 |

| 10 grams | R11,800 | $620 |

| 20 grams | R23,900 | $1,240 |

| 50 grams | R59,000 | $3,100 |

| 100 grams | R129,000 | $6,800 |

| 250 grams | R295,000 | $15,500 |

| 500 grams | R590,000 | $31,000 |

| 1 kilogram | R1,180,000 | $62,000 |

18K Gold Price in South Africa – ZAR & USD (1 g to 1 kg)

| Weight | Price (ZAR) | Price (USD) |

| 1 gram | R970 | $51 |

| 2 grams | R1,940 | $102 |

| 5 grams | R4,850 | $255 |

| 10 grams | R9,400 | $510 |

| 20 grams | R12,900 | $1,360 |

| 50 grams | R48,500 | $2,550 |

| 100 grams | R97,000 | $5,100 |

| 250 grams | R242,500 | $17,000 |

| 500 grams | R645,000 | $25,500 |

| 1 kilogram | R970,000 | $51,000 |

Current Estimated Rate (as of May 21, 2025):

- 1 g of 18K gold = R970 ZAR

- 1 g of 18K gold = $51 USD

(Based on daily spot prices and the prevailing ZAR/USD exchange rate; actual prices may vary slightly.)

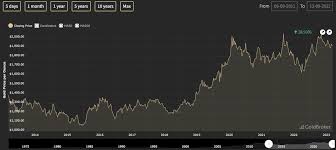

Historical Gold Prices in South Africa (2020–2025)

Overview:

Over the past five years, the average 24K gold price per gram in South Africa has steadily risen in both local and international terms, though USD prices saw a slight dip in 2022 before climbing again. This reflects a combination of global spot price movements and fluctuations in the ZAR/USD exchange rate. gold rate in South Africa

Key Takeaways:

- ZAR Trend: From R950/g in 2020 to R1,350/g by 2025, an overall increase of 42%.

- USD Trend: From $55/g in 2020 to $75/g in 2025, a net rise of 36%, with a minor correction in 2022.

- Drivers: Global economic uncertainty, COVID-19 impacts (2020–2021), shifting monetary policy, and Rand volatility have influenced these trends.

Table: Average 24K Gold Price per Gram

| Year | Price (ZAR) | Price (USD) |

| 2020 | R950 | $55 |

| 2021 | R1,050 | $60 |

| 2022 | R1,180 | $58 |

| 2023 | R1,250 | $64 |

| 2024 | R1,300 | $70 |

| 2025 | R1,350 | $75 |

Trend Charts

- ZAR Chart: Shows a steady climb from 2020 to 2025, reflecting growing domestic gold valuations.

- USD Chart: Illustrates how gold’s dollar price dipped in 2022 before accelerating upward through 2025.

Why These Trends Matter:

- Investors can gauge entry points by observing past corrections (like 2022).

- Local buyers should consider currency strength, as a weaker Rand amplifies domestic price gains.

- Market watchers gain insight into how South Africa’s gold sector responds to global and local economic shifts. gold rate in South Africa

What affects gold prices in South Africa?

- Global Gold Spot Price Movements

The single biggest driver of local gold rates is the global spot price, which reflects real-time trading on major exchanges (like London, New York). When geopolitical tensions rise or investors seek a safe haven, demand for gold spikes and spot prices climb. Conversely, when equity markets rally or risk appetite returns, gold prices can retreat. Since South African dealers and refiners base their ZAR prices on this international benchmark (converted at current exchange rates), any uptick or decline abroad is quickly passed through to local consumers and investors.

- ZAR/USD Exchange Rate Fluctuations

Because gold trades globally in US dollars, the strength or weakness of the South African rand against the dollar has a direct impact on domestic gold prices.

- Weak Rand (higher USD/ZAR): Even if the dollar‐denominated gold price is flat, a depreciated rand makes buying a given ounce of gold more expensive in ZAR terms.

- Strong Rand (lower USD/ZAR): A rallying rand can offset rising dollar gold prices, making gold cheaper for local buyers. gold rate in South Africa

This currency interplay often amplifies or dampens global moves for South African consumers.

- Local Mining Output and Supply Dynamics

South Africa is one of the world’s top gold producers, so changes in domestic mining production can influence local supply and therefore prices.

- Mine Strikes or Power Shortages: Operational disruptions (like labor disputes, Eskom load‐shedding) reduce output, tightening supply, and pushing prices up.

- New Discoveries or Expanded Capacity: Conversely, substantial new finds or extended mine lives can increase expected future supply, exerting downward pressure on prices.

- Inflation, Interest Rates & Monetary Policy

Gold is traditionally viewed as an inflation hedge. When South Africa’s inflation rate accelerates or the Reserve Bank maintains low interest rates, gold becomes more attractive than cash or bonds, driving up demand and prices. By contrast, if the SARB aggressively hikes rates to combat inflation, yields on fixed-income instruments rise, reducing gold’s relative appeal and potentially softening its price. gold rate in South Africa

- Domestic Demand & Regulatory Environment

Lastly, local demand from jewelry buyers, investors purchasing bars/coins, and industrial users shapes short-term price swings:

- Festive Seasons & Weddings: Higher jewelry purchases during celebrations can lift demand in Q4, creating seasonal price bumps.

- Regulatory Changes & Import Duties: Any new taxes, import restrictions, or licensing rules for bullion dealers can add cost layers or slow supply chains, influencing how quickly global price changes reflect in the South African market.

Note. Gold prices in South Africa are the result of a complex interplay between global spot rates, the rand-dollar exchange rate, domestic mining conditions, macroeconomic policy, and local demand/regulations. By monitoring each of these five factors, buyers, sellers, and investors can better anticipate price movements and time their purchases or sales for optimal value.

Buy Gold in South Africa.

When you’re ready to buy gold in South Africa, choosing a reputable dealer is important for an authentic product, competitive pricing, and secure delivery. Below are the top 5 trusted dealers, both online and brick-and-mortar, for purchasing physical gold in 2025, plus key pricing tips to help you get the best value.

- Gold Buyers Africa

Type: Online Retailer (Bars & Coins)

Overview: A leading pan-African dealer offering a wide selection of 24K bars, Krugerrands, and private-mint bullion with door-to-door delivery. gold rate in South Africa

Why Choose Them:

- Transparent Pricing: Real-time ZAR & USD rate calculator on their platform.

- Flexible Payment: EFT, credit card, and crypto options.

- Buy-Back Guarantee: Lock in a repurchase price within 30 days of purchase.

Pricing Tips:

- Use their “Buy More, Save More” tiered-discount feature for orders above R250,000.

- Sign up for email alerts to catch limited-time premium discounts

- Rand Refinery

Type: Wholesale & Retail Bars

Overview: As the world’s largest integrated single-site gold refinery, Rand Refinery produces LBMA-approved 1 g–1 kg gold bars stamped with the South African Mint logo.

Why Choose Them:

- Pure 24K Gold (999.9 Finely): LBMA-accredited quality guarantees global acceptance.

- Competitive Premiums: Low mark-up over spot price, especially on larger bars (100 g+).

- Local Pickup & Export: Collections from Johannesburg or secure international shipping.

Pricing Tips:

- Order 50 g or 100 g bars to minimize per-gram premium.

- Check live spot price feeds on randrefinery.co.za before placing an order.

- South African Mint

Type: Gold Coins & Commemoratives

Overview: The Mint’s flagship product is the Krugerrand, the world’s first bullion coin—available in 1 oz, ½ oz, ¼ oz, and 1/10 oz sizes, plus special-edition coins.

Why Choose Them:

- Recognized Legal Tender: Universally tradable with modest premiums.

- Collectible Editions: Seasonal releases and proof coins for numismatic appeal.

- Nationwide Distribution: Available through partnered banks and select post offices.

Pricing Tips:

- Buying in bulk rolls of 20 × 1 oz Krugerrands often nets a lower per-coin premium.

- Compare secondary-market prices on reputable auction sites during off-peak seasons.

- BullionVault

Type: Global Online Marketplace (Allocated Gold)

Overview: Though UK-based, BullionVault maintains secure vaults in Johannesburg where you can buy, store, and sell allocated gold in professional-grade bars.

Why Choose Them:

- Low Storage Fees: From 0.12% p.a. for local vault storage.

- Trade 24/7: Instant execution at live market spreads.

- Physical Redemption: Option to withdraw your metal for delivery in South Africa.

Pricing Tips:

- Compare spread percentages between USD and ZAR markets within the platform.

- Take advantage of larger trades to negotiate narrower spreads.

- Absa Bank – Precious Metals Desk

Type: Bank-backed Gold Investments & Bars

Overview: Absa offers direct purchase of small 1 g–100 g gold bars (Branded “Absa Gold Bar”), as well as gold savings accounts linked to spot prices. gold rate in South Africa

Why Choose Them:

- Bank-Grade Security: Purchases backed and insured by a major South African bank.

- Integrated Accounts: Link your gold holdings to Absa banking for easy liquidity.

- Regulatory Oversight: All transactions comply with SARB reporting.

Pricing Tips:

- Waive the small transaction fee by maintaining a minimum gold-account balance.

- Use Internet Banking FX rates for better ZAR/USD conversions when buying.

Pricing Tips Checklist

- 1. Compare Premiums: Always look beyond spot price check dealer mark-ups, shipping, and insurance.

- Buy Larger Units: Bars of 50 g+ typically carry lower per-gram premiums.

- Monitor Exchange Rates: A stronger rand vs USD can reduce your effective ZAR cost.

- Shop Seasonally: Post-holiday or mid-year demand dips often yield better deals.

- Negotiate on Bulk: Many dealers offer discounts for orders above R200,000.

Gold rates Johannesburg, Cape Town, & Durban

Base Spot Rate (24K): R1,290 ZAR / USD 68 per gram

Live Gold Price Per Gram

| City | Price (ZAR) | Price (USD) |

| Johannesburg | R1,290 | $68 |

| Cape Town | R1,315 | $69 |

| Durban | R1,310 $69 | $69 |

Prices include typical dealer mark-ups (varies by exact location, volume, and purity checks). Always confirm with the dealer before purchase.

Gold rates in Johannesburg

Price: R1,290 / $68 per gram (24K)

Top Dealers:

- Rand Refinery (Johannesburg Mint Branch)

They offer LBMA-accredited 1 g–1 kg bars and low premiums on 50 g+ bars

- African Gold Refinery

They offer full supply chain traceability and Bulk discounts for 100 g orders

- Gold Buyers Africa (Gauteng Office)

They provide Real-time ZAR & USD pricing online, and a Buy-back guarantee within 30 days

Gold Rates in Cape Town

Price: R1,315 / $69 per gram (24K)

Top Dealers:

- Cape Town Mint & Refinery

They offer 1 g–500 g bars, local pickup at Table Bay Wharf, and Seasonal premium discounts in off-peak months

- CoinChange Cape Town

They specialize in Krugerrands and private-mint coins, and also provide competitive pricing on 99.9% fine bars

- The Bullion Shop (Claremont)

It’s a personalized service, and secure storage options with free assay testing on purchases of 10 g. gold rate in South Africa

Gold rates in Durban

Price: R1,310 / $69 per gram (24K)

Top Dealers:

- Durban Bullion Traders

They seller from 1 g–1 kg 24K bars, same-day delivery in KZN, and they offer tiered pricing for bulk buyers

- Goldkist Refinery

They specialize in smaller gram-size bars (1 g–10 g), and Instant price quotes via WhatsApp

- Eastern Gold Exchange

They offer coin and bar swaps with minimal spread and provide on-site secure vault storage

Quick Tips for Local Buyers

- Call Ahead: Confirm daily premiums and assay fees.

- Buy Larger Units: 50 g+ bars often lower your per-gram cost.

- Compare Quotes: Dealers in different suburbs may have varied mark-ups.

- Check Payment Terms: Some offer better rates for EFT vs. card.

- Inspect Certificates: Always get a refinery assay card with your purchase.

Conclusion:

By keeping an eye on daily gold rates in South Africa from 24K through 18K and across major cities, you empower yourself to make smarter buying and investment decisions. Remember that global spot prices, the ZAR/USD exchange rate, and local supply-demand dynamics all play a role in price fluctuations. Whether you’re purchasing bullion bars, Krugerrands, or smaller gram-size bars, always compare premiums, verify assay certificates, and choose reputable dealers. Staying informed with live rate updates and understanding the key influencing factors will ensure you lock in competitive pricing and secure your gold with confidence. gold rate in South Africa